REGISTER YOUR OPPORTUNITY L.A. ACCOUNT TODAY!

If you already have your 15-digit account number, visit mysavingsaccount.com/account/ola to create your login credentials.

Account numbers and information were sent to families in a Welcome Packet during the spring semester of the student’s 1st grade year.

You will need the following information when registering your account:

- Your student's Opportunity L.A. account number

- Your student's date of birth

- The zip code used to register your student at LAUSD

If you don't have your account number, please fill out the request form HERE.

Or contact us at cifd.opportunityla@lacity.org.

About Opportunity L.A.

The Opportunity L.A. (OLA) Program provides LAUSD first-grade students with free money to kickstart their college savings through a Children’s Savings Account (CSA). In collaboration with the County of Los Angeles and the Los Angeles Unified School District (LAUSD), the City of Los Angeles establishes CSAs for students, enabling them and their families to make additional deposits to enhance their college fund.

Did you know?

Students with college savings are:

- 3 times more likely to go to college

- 4 times more likely to graduate from college

Benefits of an Opportunity L.A. Account

An Opportunity L.A. children's savings account sets the stage for your child's future education.

- Automatic Enrollment: First grade LAUSD students are automatically given a savings account when they enroll in a LAUSD elementary school. Families have the ability to opt out of the program if they choose to.

- Easy Access: Families can make deposits conveniently, either in person at a local Citibank branch or online.

- Inclusive Access: These savings accounts are available to all students, regardless of income, background, or immigration status.

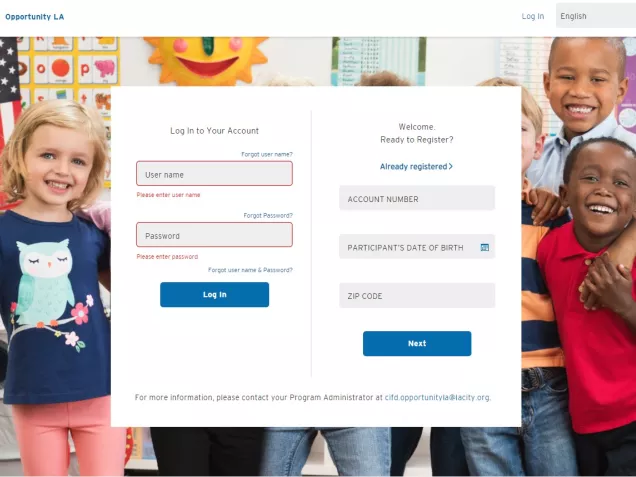

Accessing Your Account

- To begin, visit https://mysavingsaccount.com/account/ola.

- Select the option to register on the right side of the screen. You will need to input your student's OLA information:

- Account number (If you don't have your account number, please fill out THIS FORM)

- Date of Birth

- Note : Format for date of birth should be MM/DD/YY

- Ex: A student born July 1, 2021, would have a date of Click at the bottom birth format as 07/01/2021

- Zip code

- Note: The zip code is the one you use to register your student in a LAUSD school

- Then click "Next"

- A pop up window will appear on screen with the Program Rules. Read through the program rules, scroll down to the bottom, and click "Accept".

- Create a password and username. Please follow the rules below

- Username: input your email and create a username following these rules:

- Must be 8 to 38 characters

- Must include at least 1 number

- No special characters allowed: !@#$ %^()-+^& ) (;:?.

- Cannot have a space

- Username should be alphanumeric

- Password: Create a password following these rules:

- Must be different from your username

- Must have between 6-32 characters

- Must include 2 letters, 2 numbers, 1 upper case, and 1 lowercase

- Must include 1 special character from approved list: !@#$ %^( )-+^& ) (.

- Cannot have a space

- Username: input your email and create a username following these rules:

- Choose and answer the security questions listed and then click "Next". These questions are important to remember in case you forget your password or username. You will need to answer your security questions in order to reset your username and/or password in the future.

- After you create security questions, a message will be promoted congratulating you for registering online. Click "Login" to access your students OLA account using the new username and password you created to view the balance online.

- You can now view your student’s total funds, including your deposits, contributions and Opportunity L.A. savings rewards earned.

Register or log in to your OLA Account

Forms And Documents

Click the following link for:

- OLA Parent Flyer English

- OLA Parent Flyer Spanish

- OLA Parent Flyer Simplified Chinese

- OLA Parent Flyer Korean

- OLA Parent Flyer Armenian

- OLA Parent Flyer Farsi

- OLA Parent Flyer Tagalog

- Opt-Out Form: DUE 10/25/2024

- Program Rules and Guidelines

- Program Rules and Guidelines Spanish

- Account Closure Form

- Account Closure Form Spanish

- Direct Deposit Form

- Citibank Branch Locations

Frequently Asked Questions

About the Program

- How do I enroll my student?

During the Spring semester, LAUSD first graders enrolled in participating elementary schools will have an account automatically opened for them, unless their parent/guardian opted out. If you would like for your student to receive an Opportunity L.A. account, there is no action needed. If you have any questions about accessing your student's account please send us an email at cifd.opportunityla@lacity.org.

- What is the cost to participate in Opportunity L.A. (OLA)?

There is no cost to a student or a family to participate in Opportunity L.A.

- What is needed to register a student's account?

When an Opportunity L.A. (OLA) account has been opened in the student’s name, students and parents will have access to an online banking platform. To register the account online, use this link https://mysavingsaccount.com/account/ola.

You will need to provide the following information:

- Student account number found in the welcome letter (mailed to you)

- Student’s Date of Birth

- Your Email address

If you have questions regarding the account number please contact us at cifd.opportunityla@lacity.org.

- What can you use these savings for?

Program funds may be used for pre-college education expenses and post-secondary education. Qualified account uses will be determined by the Program and include, but are not limited to:

- Pre-college expenses such as college application fees, ACT/SAT testing fees or preparatory classes

- Pre-enrollment enrichment services such as “summer bridge” programs, deposits for on-campus room and board

- Post-secondary expenses such as tuition, mandatory fees, books, supplies (including computer equipment)

- Post-secondary education includes: colleges; universities; vocational schools; and any two or four-year degree programs from accredited institutions.

To be eligible for a qualified account use, the participant must either be currently enrolled in or have graduated from an LAUSD high school. Certain restrictions apply.

- How do I opt my student out of the program?

Parents who choose other ways to save or do not want to participate in the program may opt out.

For first grade families, at the beginning of the school year look for the Information Release Form in your Parent/Student Handbook. You can indicate there that you do not wish to participate, and no account will be created. The form must be submitted to your school.

Later in the school year: You will also receive an Opt-out letter to complete and submit to your school. The opt-out letter will NOT go to the program, please share it with your student’s school.

Once a Student Account is Open

- How can I make a deposit to increase my savings?

Did you know that you and your loved ones can make deposits into an Opportunity L.A. (OLA) account? All you need is the student’s name and account number. This can be done in a variety of ways

Option 1:

In-person at a local Los Angeles Citibank branch:

- Visit: https://online.citi.com/US/ag/citibank-location-finder

- Enter your address

- Select “Filter”

- Select “Branches” and then “Apply Filter”

At the Citibank branch parents will be asked to present a valid government-issued photo ID and they will be asked to provide a Social Security Number. Sharing a SSN is completely OPTIONAL. Parents do not need to provide a SSN to make a deposit, they are allowed to decline. The question is part of banking regulations, but a response is not required.

While depositing in person, parents can provide cash, check, or money order. Parents will need to have the student’s Opportunity L.A. account number, which they received in their welcome packet, and the student’s full name. If parents do not have their student’s account number, they may fill out this online form to request one.

Option 2:

By Mail

Make a check or money order payable to the student's name, include their account number in the memo section of the check, and mail to:

Citi Children’s Savings Accounts

P.O. Box 790020

St. Louis, MO 63179-9966Option 3:

Bill Pay

Step 1 : Log into your bank's online portal and proceed to the "Bill Pay" section.

Step 2: Enter and save the Bill Pay merchant details as follows for all fields as applicable:

- Merchant Name : Opportunity LA

- Account # : [Your student's account number that starts with "3322209"]

- Merchant Address : P.O Box 790020, St Louis, MO 63179-9966

*** Please note that the initial Bill Pay set up takes approximately 4-6 weeks.

Option 4:

Direct Deposit

Fill out this form and submit it to your employer or other fund originator.

- How does the Program help me grow my savings?

The Program offers a number of opportunities - called “incentives” - to grow your savings. You can earn these incentives by meeting certain requirements or engaging with the program. Keep an eye out for future communications on these opportunities.

- How do I make a deposit using Bill Pay?

Look for the Merchant Name Opportunity L.A. (OLA) in your bank’s Bill Pay service. You can set up a one-time payment or recurring payments to the Participant’s account record using this service. * Please note that the Bill Pay takes approximately 4-6 weeks for the initial setup to process.

- Will participation in the Program impact the other benefits I already receive, such as CalFresh or WIC?

No, since these accounts are held by the City of Los Angeles on behalf of the student, these funds will not be counted as income for purposes of eligibility for other benefits.

- What if I cannot find "OLA" as a merchant in my bank’s Bill Pay?

If you need to set up the OLA Program as a Bill Pay merchant at your financial institution, follow the steps below:

Log into your bank’s online portal and proceed to the Bill Pay section.

Enter and save the Bill Pay merchant details as follows for all fields as applicable:

Merchant Name — Enter Program Name (Opportunity LA)

Account # — Enter your student’s XX-digit account number (provided in the welcome letter starting with "3322209")

Merchant Address — Enter the address: P.O. Box 790020 St. Louis, MO 62179-9966

Merchant Phone Number — XXX-XXX-XXXX

Follow the prompts to add the merchant and set up a one-time or recurring payment. Once you have entered this merchant in your bank’s Bill Pay section, you will not have to enter the merchant’s information again and all payments will be sent electronically.

How it Works

- Can funds be withdrawn from this Program account in the case of a financial emergency?

In the case of a family emergency, the student or parent/guardian may request an early withdrawal of some or all contributions in the student’s account. **Restrictions apply. Contact the program for more details.

- What happens to the Opportunity L.A. (OLA) Student account, if the Student transfers from one school to another?

If a student who has an Opportunity L.A. (OLA) account transfers to another LAUSD school, the student’s school information is updated and the OLA account continues as is. If the student leaves LAUSD, then the student’s OLA account will be closed. Online viewing access of a student’s OLA account will be terminated as of the date of account closure. If any Non-Program Contributions were made to the OLA account, a repayment will be made payable to the student’s name and will be mailed to the address on record within twenty (20) business days of the OLA account closure. All incentives and Program Contributions are returned to the Program. The parent or legal guardian of the student will be asked to destroy and discard the student’s account ID Card.

If the student who previously participated in the Program returns to an LAUSD school, a new OLA account may be established for the student and, depending on funding availability, the initial seed deposit will be credited to the new OLA account. Please contact the OLA program manager at cifd.opportunityla@lacity.org for additional inquiries.- How does Opportunity L.A. differ or work with ScholarShare 529 accounts?

Opportunity L.A. differs from ScholarShare 529 in that our program is an opt-out model, the accounts are accessible to anyone regardless of their legal status, the program will not affect a family’s public benefits, and is completely free for families. ScholarShare 529 models are typically opt-in, gain a higher interest but will likely be reportable for tax and benefit purposes. ScholarShare 529 accounts may also have penalties for early withdrawals.

- Can the funds be transferred into a 529 account?

Contributions made by parents, family, friends or legal guardians may be transferred to a 529 account upon request by the participant. All program contributions including the initial deposit and any incentive that the student has earned from Opportunity L.A. while in the program cannot be transferred and will stay in the custodial account. The student account will remain open unless a parent or legal guardian requests to close the account at which point they must fill out a student account closure form.

Additional Resources

CalKIDS

- About CalKids

The State of California launched the California Kids Investment and Development Savings Program (CalKIDS). CalKIDS helps children get access to higher education, especially those from traditionally underserved communities. CalKIDS gives children in California a jump start on saving for college or career training. To be eligible for CalKIDS, participants must be:

Born in California on or after July 1, 2022

OR

Low-income California public school student in grades 1-12 during the 2021-2022 school year

OR

Low-income California public school student attending grade 1 during the 2022-2023 school year and every year after

Enrollment in CalKIDS is automatic. Eligible beneficiaries are identified by the California Department of Public Health and the California Department of Education. No action or financial commitment is required of families to participate.

All participants receive a seed deposit in a CalKIDS account to help pay for future education after high school.

CalKIDS savings can be used for qualified higher education expenses like tuition, books, computer equipment, supplies, and more.

Awardees have until the age of 26 to use funds and must have been California residents in the year preceding their request for disbursement. Payments are made directly to the institution of higher education. CalKIDS funds can be used nationwide and occasionally abroad at community colleges, universities, vocational and professional schools.

Visit CalKIDS.org to register, link your CalKIDS and ScholarShare 529 account, and to follow the latest program guide and updates.

- Eligibility

Eligibility has two awardee groups – automatically enrolled with an initial seed.

- Newborns (California Department Of Public Health Data)

- Born in California, on or after July 1, 2022;

- Initial seed regardless of income;

- Established when data is received from CA Dept of Health (takes about 90 days).

- Low-income* Public School Students (California Department Of Public Education data)

- Accounts established for 1-12th graders in 2021-2022 academic year (enrolled as of Fall census day October 6, 2021)

- Accounts will be established for 1st graders every school year (enrolled as of Fall Census Day, first Wednesday of October)

- Accounts typically become available during the summer after a student finished 1st grade

*Eligibility for low-income public school participants is defined by the Local Control Funding Formula. Historically, this information has been collected from parents through the Free and Reduced Lunch Form. Please complete any requests from your school district related to household income to ensure you are counted for CalKIDS and related resources.

- Newborns (California Department Of Public Health Data)

- Get Started

- Newborns

- Get started at CalKids.org. Eligible newborns must be born in California on or after July 1, 2022.

- CalKIDS receives information on newborns approximately 90 days after birth is registered with the California Department of Public Health.

- Families will receive a welcome letter and a unique code to register a newly established CalKIDS account. Families can also input the “local registration number” located at the top right of the birth certificate issued by the county.

- If families have an existing or new 529 account at ScholarShare, they can link their CalKIDS account and the 529 account for their student.

- Students

- Get started at CalKids.org. Eligible 1-12 grade low-income public-school students must have been enrolled as of Fall census day (October 6, 2021). Low-income public-school students for the 2022-2023 school year

- Families will receive a welcome letter and unique code to register their newly established CalKIDS account by late Spring or Summer. Families can also visit CalKids.org and input the Statewide Student Identifier Number (SSID). Families may contact their school district or the school of their student for their SSID.

- Newborns

- How is CalKIDS different from Opportunity L.A.?

- Unlike Opportunity L.A., families are not able to directly contribute to a CalKIDS account. However, after they register to view their CalKIDS account they can link it to a new or existing California ScholarShare 529 account for their student, so families can see their savings grow over time.

- A 529 college savings plan is an investment plan managed and sponsored by a state that allows families to save money for future education expenses. Families can withdraw funds tax-free to cover qualified higher education expenses. If families are able to save some of their own money for your child’s future college costs, a 529 plan is an excellent option to use in addition to Opportunity L.A.

- Check out the “ScholarShare 529” section below for more on the benefits of California ScholarShare and how to save alongside it and Opportunity L.A.

- Have More Questions?

Opportunity L.A. can answer basic questions if you email cifd.opportunityla@lacity.org, but our friends at ScholarShare who administer CalKIDS and the state’s 529 are the experts. Here’s where to get support:

- Visit ScholarShare529.com and CalKIDS.org to get started and view frequently asked questions (FAQs)

- Join ScholarShare webinars and watch CalKIDS YouTube tutorials

- Schedule appointments with multilingual consultants who are licensed to provide financial advice about investment options with California ScholarShare’s 529 account

Call 888-445-2377 Monday to Friday between 8 am to 5pm or email support@calkids.org

ScholarShare 529

- 529 College Savings Plan

A 529 plan is an investment account that allows earnings to grow free from federal income tax when funds are used for qualified educational expenses including books, fees, supplies and tuition at universities, community colleges or trade schools. Though there are many state 529 plans to choose from.

Check out planning and saving for college and comparison tools on California ScholarShare’s website as you weigh your options.

- California ScholarShare

ScholarShare 529 is administered by the ScholarShare Investment Board, which is chaired by California State Treasurer Fiona Ma. Since its launch in 1999, ScholarShare 529 has helped thousands of families save for a higher education and has grown its total plan assets to almost $10.5 billion as of September 2020.

CA 529 ScholarShare Brochure.

- Things to Consider

- Learn more about the California 529 College Savings Plan, its investment objectives, tax benefits, risks, and costs, please see the Plan Description at www.ScholarShare529.com. Read it carefully.

- Check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. Consult your legal or tax professional for tax advice.

- Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss.

- If the funds aren't used for qualified higher education expenses, a 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Non-qualified withdrawals may also be subject to an additional 2.5% California tax on earnings.

- The treatment of investments in a 529 savings plan varies by school. Assets are typically treated as the account holder’s and not the student’s. (Student assets are generally assessed at 20% whereas parental assets are generally assessed at 5.6%.) Any investments, including those in 529 accounts, may affect the student's eligibility to get financial aid based on need. You should check with the schools you are considering regarding this issue.

Definitions for Program Guidelines

- Opportunity L.A. (OLA): Program name for the City of Los Angeles Children's Savings Account program.

- Children’s Savings Accounts (CSAs): Long-term, restricted savings accounts established for first-grade students enrolled in participating LAUSD schools to support student’s post-secondary education.

- County Student (“County Student”): CSA Program-eligible first graders enrolled in participating LAUSD schools that reside in the unincorporated areas of the County and cities outside the City of Los Angeles.

- City Student (“City Student”): CSA Program-eligible first graders enrolled in participating LAUSD schools that reside within the boundaries of the City of Los Angeles.

- Custodial Account (“Custodial Account”): Financial account that incorporates CSAs, established for the benefit of the Student. Administered and managed by the CSA Program in accordance with the program Memorandum Of Agreement (MOA).

- Incentive (“Incentive”): Any additional CSA funding, not including family or friend’s contributions, beyond the CSA Seed Funds that may be contributed to CSAs based upon specific criteria established and mutually agreed upon by all the Parties. Students may earn monetary Incentives only while enrolled in an eligible LAUSD school.

- Legal Guardian (“Legal Guardian”): Someone who is not the child’s parent, however, has legal custody of the child and can provide health, education, and financial decisions on behalf of the child.

- Non-Program Contributions or Non-Program Funds (“Non-Program Contribution or Non-Program Funds”): Deposits of funds contributed to a CSA by a person or organization not at the direction or associated with the CSA Program for the benefit of the student.

- Participating Schools (“Participating Schools”): LAUSD Schools selected for the CSA Program each Year and subject to the Program requirements.

- Program Contributions or Program Funds (“Program Contribution or Program Funds”): Initial Seed Deposit, Incentives, and any growth amount accrued by the Custodial Account for the benefit of the Students.

- School Selection Plan (“School Selection Plan”): Yearly plan used to identify LAUSD schools to participate in the CSA Program as mutually agreed upon by all the Parties.

- Seed Funding (“Seed Funding”): Initial funding to establish CSAs for the benefit of Students as agreed upon by all the Parties.

- Student or Participant (“Student" or "Participant”): A City or County Student that is the intended beneficiary of the CSA and a) currently attends an LAUSD school or b) graduated from an LAUSD high school.

- Year (“Year”): July 1st to June 30th.

- Escheat: A legal process that transfers ownership of abandoned property, in this case CSA program funds, to the state in accordance with state law. Before the state can take full ownership, it must attempt to find the owners (Student, Student parent or legal guardian) and provide an opportunity for the Student to claim their funds.

Contact

For additional information about the program, contact us at: cifd.opportunityla@lacity.org (213) 820-4283